Life insurance policies offer a range of benefits to policyholders, including a death benefit or financial compensation that is paid out to beneficiaries upon the death of the policyholder. Variable death benefits are an attractive option for policyholders who are looking for more flexibility and control over their life insurance policy and payout. In this article, we’ll explore the ins and outs of variable death benefits in life insurance and highlight the different pros and cons of this option.

Understanding Variable Death Benefits in Life Insurance

Variable death benefit, as the name suggests, refers to the death benefit that is not fixed but varies according to certain conditions, such as changes in the market or investment performance. This means that the payout beneficiaries receive could differ depending on the performance of the underlying investments in the policy.

Policyholders who opt for variable death benefits have more flexibility in managing their life insurance policy. Policyholders can choose between different types of investment options, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs), to determine the underlying investments in their policy.

It is important to note that variable death benefits come with higher risks compared to fixed death benefits. The value of the underlying investments can fluctuate, which means that the death benefit payout could be lower than expected if the investments perform poorly. On the other hand, if the investments perform well, the death benefit payout could be higher than expected. Policyholders should carefully consider their risk tolerance and investment goals before opting for variable death benefits.

How Variable Death Benefit Works: A Comprehensive Guide

Investment performance has a direct impact on the amount of the death benefit. If the investments perform well, then the death benefit payout increases. On the contrary, if the investments perform poorly, then the death benefit payout decreases. However, there is usually a minimum death benefit amount that is guaranteed regardless of how the investments perform.

One of the key aspects of a variable death benefit is the “ratchet” feature. The ratchet feature is essentially a mechanism that locks in the highest death benefit payout achieved by the policy. This means that even if the investments perform poorly in subsequent periods, the death benefit payout will not fall below the highest amount achieved earlier.

It is important to note that variable death benefits are typically associated with variable life insurance policies. These policies allow policyholders to invest in a variety of investment options, such as stocks, bonds, and mutual funds. The investment options available to policyholders can vary depending on the insurance company offering the policy.

Pros and Cons of Choosing a Variable Death Benefit

Like with any financial product, variable death benefits have their advantages and disadvantages. One of the main benefits of a variable death benefit is the flexibility it provides. Policyholders can choose the underlying investments that best match their risk tolerance and financial goals. They can also adjust their investments throughout their life as their financial circumstances change.

However, variable death benefits come with higher risk and uncertainty. The death benefit payout is not guaranteed, and market fluctuations can lead to a lower payout at the time of death. Additionally, variable death benefits tend to have higher fees and expenses than fixed death benefits.

Another advantage of variable death benefits is the potential for higher returns. Since policyholders can choose their investments, they have the opportunity to earn higher returns than with a fixed death benefit. This can be especially beneficial for those who have a longer investment horizon and are willing to take on more risk.

On the other hand, one of the disadvantages of variable death benefits is the complexity of the product. It can be difficult for policyholders to understand the underlying investments and how they impact the death benefit payout. This can lead to confusion and potentially poor investment decisions. Additionally, variable death benefits may not be suitable for those who are risk-averse or have a shorter investment horizon.

Factors to Consider Before Opting for a Variable Death Benefit

If you’re considering a variable death benefit, it’s essential to carefully consider your financial circumstances and risk tolerance. Make sure you understand the risks involved and have a clear plan for managing the underlying investments. Consulting with a financial advisor can also be helpful in making an informed decision.

Keep in mind that while a variable death benefit offers more flexibility and control, it may not be the best option for everyone. If you’re looking for a guaranteed death benefit payout or have a low risk tolerance, a fixed death benefit may be a better choice.

Another important factor to consider before opting for a variable death benefit is your investment horizon. If you have a long-term investment horizon, a variable death benefit may be a good option as it allows for potential growth over time. However, if you have a short-term investment horizon, a fixed death benefit may be a better choice as it provides a guaranteed payout.

It’s also important to consider the fees associated with a variable death benefit. These fees can include management fees, administrative fees, and mortality and expense fees. Make sure you understand these fees and how they will impact your investment returns before making a decision.

How to Use a Variable Death Benefit to Customize Your Life Insurance Policy

One of the most significant benefits of a variable death benefit is the customization it provides. Policyholders can choose the underlying investments that align with their financial goals, such as growth, income, or stability. They can also adjust their investments as their financial circumstances change over time.

Additionally, variable death benefits can be combined with other options, such as accelerated death benefits, which allow policyholders to access a portion of the death benefit while still alive if they become critically ill or disabled and need care.

Another advantage of a variable death benefit is that it can provide a higher potential payout than a traditional fixed death benefit. This is because the value of the policy is tied to the performance of the underlying investments, which can increase over time. However, it’s important to note that there is also a risk of loss with variable death benefits, as the value of the investments can also decrease.

What Happens to Your Life Insurance Payout with a Variable Death Benefit?

As mentioned earlier, the death benefit payout with a variable death benefit is not fixed but changes based on investment performance. If the investments perform well, then the death benefit payout increases. If the investments perform poorly, then the death benefit payout decreases. However, there is usually a minimum death benefit amount that is guaranteed regardless of how the investments perform.

Additionally, the ratchet mechanism ensures that the death benefit payout does not fall below the highest amount achieved earlier. This means that the death benefit payout can only increase or remain the same, but never decreases below the highest amount previously achieved.

It is important to note that a variable death benefit may come with higher fees and expenses compared to a fixed death benefit. This is because the insurance company is taking on more risk by tying the death benefit payout to investment performance. As a policyholder, it is important to carefully consider the potential benefits and drawbacks of a variable death benefit before making a decision.

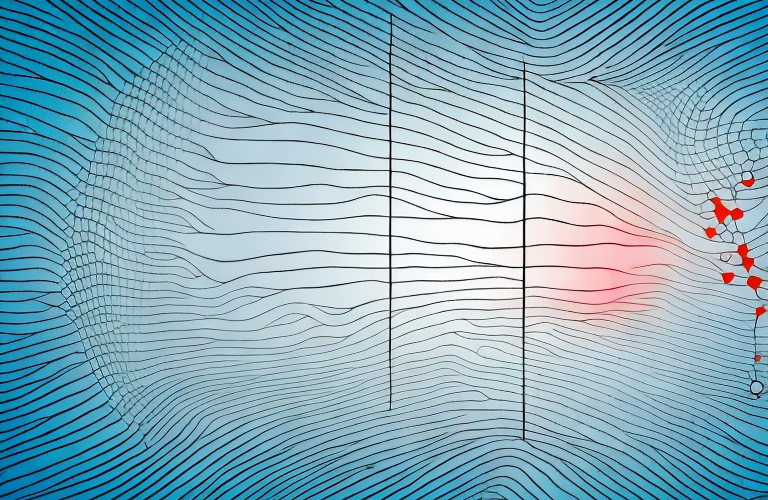

The Impact of Market Fluctuations on Variable Death Benefit

The performance of the underlying investments is the most significant factor that affects the death benefit payout with a variable death benefit. Market fluctuations and economic conditions can lead to significant changes in the investments and ultimately affect the death benefit payout. It’s important to manage the underlying investments carefully and have a clear plan for managing risk. Consultation with a financial advisor can be helpful in managing the investments.

Another factor that can impact the death benefit payout is the age and health of the policyholder. If the policyholder passes away at a younger age or in good health, the death benefit payout may be higher than if they were older or in poor health. This is because the insurance company assumes a longer life expectancy for younger and healthier individuals, and therefore, can invest more aggressively to potentially earn higher returns.

Additionally, it’s important to review and adjust the variable death benefit regularly to ensure it aligns with your current financial goals and needs. As your financial situation changes, you may need to increase or decrease the death benefit payout to better protect your loved ones or to meet other financial obligations. Regularly reviewing and adjusting the variable death benefit can help ensure that it continues to meet your needs over time.

Comparing Fixed vs. Variable Death Benefits in Life Insurance

Fixed death benefits and variable death benefits differ significantly in terms of the payout amount and flexibility. Fixed death benefits offer a guaranteed payout amount that does not change regardless of the investment performance. On the other hand, variable death benefits offer a payout amount that varies based on investment performance.

While fixed death benefits offer more certainty, they do not offer the flexibility and customization that variable death benefits provide. Additionally, fixed death benefits tend to have lower fees and expenses than variable death benefits.

It is important to note that the decision between fixed and variable death benefits ultimately depends on an individual’s financial goals and risk tolerance. Those who prioritize stability and predictability may prefer fixed death benefits, while those who are comfortable with market fluctuations and seek higher potential returns may opt for variable death benefits.

Common Misconceptions About Variable Death Benefits Explained

One of the most significant misconceptions about variable death benefits is that they are too risky. While variable death benefits do come with increased risk and uncertainty, they can be managed effectively if done carefully. Additionally, the minimum guaranteed death benefit amount provides a safety net for policyholders.

Another misconception is that variable death benefits are always more expensive than fixed death benefits. While variable death benefits do tend to have higher fees and expenses than fixed death benefits, they also offer greater flexibility and customization that might be worth the extra cost for some policyholders.

It is also important to note that variable death benefits are not suitable for everyone. They are designed for individuals who are comfortable with market fluctuations and have a higher risk tolerance. Those who are more risk-averse may prefer fixed death benefits, which offer a guaranteed payout but with less flexibility and potential for growth.

Conclusion

Variable death benefits in life insurance offer more flexibility and control to policyholders, but also come with higher risk and uncertainty. Policyholders should carefully consider their financial situation and risk tolerance before opting for a variable death benefit. Consulting with a financial advisor can be helpful in making an informed decision about whether a variable death benefit is the right choice.

It is important to note that variable death benefits are not suitable for everyone. Policyholders who have a low risk tolerance or who are nearing retirement may prefer a fixed death benefit, which provides more stability and predictability. Additionally, variable death benefits may not be the best option for those who are primarily concerned with leaving a guaranteed inheritance to their beneficiaries.

Despite the potential risks, variable death benefits can be a valuable tool for policyholders who are comfortable with market fluctuations and want to maximize their potential returns. By investing in a variety of funds and asset classes, policyholders can potentially earn higher returns than they would with a fixed death benefit. Ultimately, the decision to choose a variable death benefit should be based on a careful assessment of one’s financial goals, risk tolerance, and overall financial situation.