When it comes to finance, there are many terms that may not be familiar to the average person. One such term is “platykurtic”, which refers to a particular type of distribution pattern in a data set. In this article, we will explore what platykurtic means, how it affects finance, and how it can be measured and used to enhance financial performance.

What is Platykurtic and How Does it Affect Finance?

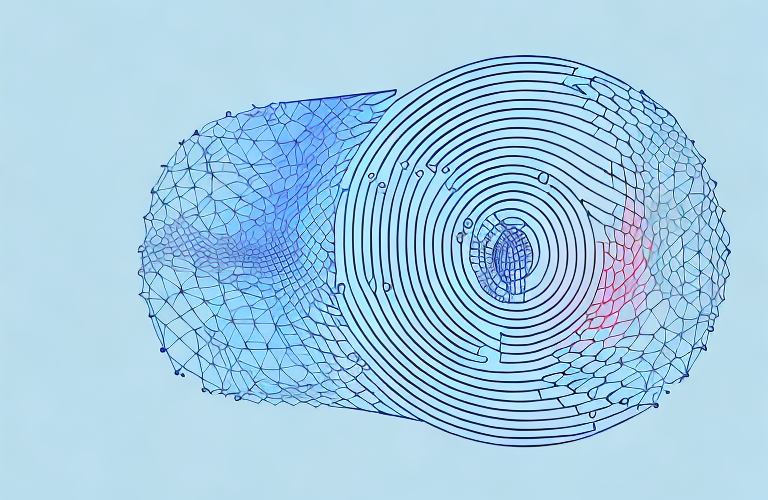

Platykurtic refers to a distribution pattern that is flatter and wider than a normal distribution. In other words, data points are more spread out and less clustered around the mean. This type of distribution is characterized by a low kurtosis value. Kurtosis is a statistical measure that describes the shape of a distribution curve. Platykurtic distributions have a kurtosis value of less than three.

Platykurtic distribution patterns can have a significant impact on finance. One of the key effects is that it can decrease the accuracy of financial forecasts. This is because financial models typically assume that data is normally distributed. However, if data is platykurtic, the actual outcomes may deviate significantly from what is predicted. This can lead to unexpected losses or missed opportunities for value creation.

Another impact of platykurtic distribution patterns on finance is that it can affect risk management strategies. Traditional risk management techniques, such as value-at-risk (VaR) models, assume that data is normally distributed. However, if data is platykurtic, these models may underestimate the true level of risk. This can lead to inadequate risk mitigation measures and potentially catastrophic losses.

Understanding the Concept of Platykurtic in Finance

In finance, it is essential to be able to accurately describe and interpret data patterns. Platykurtic is just one of many statistical terms used to describe financial data. Other examples include skewness, standard deviation, and correlation. To truly understand platykurtic, it is first necessary to have a basic understanding of probability theory and statistics.

Platykurtic distribution patterns are typically observed in data sets that have a relatively large sample size. This is because the more data points there are, the greater the chance that outliers will be present. Outliers are data points that are significantly different from the other data points in the set. They can skew the distribution and lead to platykurtic patterns.

One of the key characteristics of platykurtic distributions is that they have a flatter peak than a normal distribution. This means that the data is more spread out and less concentrated around the mean. This can make it more difficult to make accurate predictions based on the data, as there is more variability in the results.

Platykurtic distributions can also be caused by the presence of multiple modes in the data. A mode is the value that occurs most frequently in the data set. If there are multiple modes, it can lead to a flatter distribution and a platykurtic pattern. This can be particularly problematic in finance, as it can make it difficult to identify trends and make informed investment decisions.

The Significance of Platykurtic in Financial Analysis

Platykurtic distributions can have a significant impact on financial analysis. This is because they can distort statistical measures that are commonly used in financial analysis. For example, the average return on an investment could be significantly different if the data is platykurtic. This could lead to inaccurate ROI calculations, which could in turn affect investment decisions.

Another area where platykurtic distributions can impact financial analysis is in risk management. If a portfolio of investments has a platykurtic distribution, it may be more difficult to accurately assess the level of risk. This could lead to suboptimal investment decisions or unexpected losses.

Furthermore, platykurtic distributions can also affect the accuracy of forecasting models used in financial analysis. If the data used in these models is platykurtic, the models may not be able to accurately predict future trends or outcomes. This could lead to incorrect financial projections and ultimately, poor decision-making.

It is important for financial analysts to be aware of the potential impact of platykurtic distributions on their analysis. They should consider using alternative statistical measures or adjusting their models to account for the unique characteristics of platykurtic data. By doing so, they can ensure that their analysis is accurate and reliable, leading to better investment decisions and outcomes.

Exploring the Relationship Between Platykurtic and Risk Management

Risk management is a crucial aspect of finance. Platykurtic distributions can present unique challenges when it comes to risk management. One of the key issues is that platykurtic distributions can be more difficult to model and predict than normal distributions. This is because normal distributions have a well-defined shape and are relatively easy to work with, while platykurtic distributions are flatter and less well-defined.

One potential solution to this challenge is to use alternative statistical measures that are better suited to platykurtic data. For example, some analysts use quantiles or percentiles instead of standard deviation or variance. These statistical measures can more accurately capture the range of outcomes that are possible in a platykurtic distribution.

Another approach to managing risk in platykurtic distributions is to diversify investments across different asset classes. This can help to reduce the impact of extreme events that may occur in a platykurtic distribution. For example, an investor may choose to invest in a mix of stocks, bonds, and real estate, rather than putting all of their money into a single asset class. By diversifying, the investor can potentially reduce the overall risk of their portfolio and mitigate the impact of any extreme events that may occur in a platykurtic distribution.

How to Measure Platykurtic in Financial Data Sets

If you are working with financial data, it is important to be able to measure the level of platykurtic in the data set. One of the most common ways to do this is to calculate the kurtosis value. A kurtosis value of less than three indicates a platykurtic distribution.

Another way to measure platykurtic is to analyze the shape of the distribution curve. Platykurtic distributions tend to have a wider and flatter curve than normal distributions.

It is important to note that platykurtic distributions are often associated with low volatility and a higher probability of extreme events. This means that investors should be cautious when making decisions based on platykurtic data sets.

Additionally, it is possible to transform a platykurtic distribution into a normal distribution through various statistical techniques, such as log transformation or power transformation. However, it is important to carefully consider the implications of such transformations and whether they are appropriate for the specific financial data set being analyzed.

Advantages and Disadvantages of Platykurtic Distribution in Finance

Like any statistical measure, platykurtic distributions have both advantages and disadvantages. One advantage is that they can reveal important information about the distribution of data. Platykurtic distributions tend to have more extreme data points than normal distributions, which can be useful in identifying potential risks or opportunities.

However, platykurtic distributions can also be more difficult to work with than normal distributions. This is because they may require different statistical measures and models than normal distributions. Additionally, platykurtic distributions may be more prone to outliers, which can further complicate analysis.

Another advantage of platykurtic distributions is that they can help in detecting changes in the underlying data. This is because platykurtic distributions have thinner tails than normal distributions, which means that any changes in the data will be more noticeable. This can be particularly useful in finance, where sudden changes in market conditions can have a significant impact on investments.

On the other hand, one disadvantage of platykurtic distributions is that they may not accurately represent the true distribution of the data. This is because platykurtic distributions tend to have a higher concentration of data around the mean, which can mask the presence of outliers or other important data points. As a result, it is important to carefully consider the use of platykurtic distributions in finance and to use them in conjunction with other statistical measures to ensure accurate analysis.

Real-world Examples of Platykurtic in Financial Markets

Platykurtic distributions can be observed in many different financial markets and contexts. For example, some studies have found that stock market returns are often platykurtic. This means that there are more extreme returns than would be expected in a normal distribution. This can have significant implications for investors who are relying on historical data to make investment decisions.

Another example of platykurtic distribution in finance is in commodity prices. Commodity prices can be highly volatile, with occasional extreme movements in either direction. This can lead to platykurtic distribution patterns, which can make forecasting and risk management more difficult.

Platykurtic distributions can also be observed in the foreign exchange market. Currency exchange rates can experience sudden and significant fluctuations due to various factors such as political events, economic data releases, and central bank decisions. These fluctuations can result in platykurtic distribution patterns, which can make it challenging for traders to accurately predict future exchange rate movements.

Furthermore, platykurtic distributions can be seen in the distribution of credit losses in the banking industry. Credit losses can be highly unpredictable and can occur due to various reasons such as borrower default, economic downturns, and changes in regulatory requirements. The occurrence of extreme credit losses can lead to platykurtic distribution patterns, which can make it difficult for banks to accurately estimate their potential losses and manage their risk exposure.

Comparing Platykurtic with Other Statistical Measures Used in Finance

There are many different statistical measures used in finance, each with its own strengths and weaknesses. Platykurtic is just one of many measures that are used to describe the distribution of data. Some other common measures include skewness, variance, and standard deviation.

Skewness describes the asymmetry of a distribution. A positively skewed distribution has more data points to the left of the mean, while a negatively skewed distribution has more data points to the right of the mean. Variance and standard deviation are measures of the spread of data around the mean.

Another commonly used statistical measure in finance is kurtosis, which is a measure of the “peakedness” of a distribution. A distribution with high kurtosis has a sharp peak and heavy tails, while a distribution with low kurtosis has a flatter peak and lighter tails. Platykurtic distributions have lower kurtosis than normal distributions, indicating that they have flatter peaks and lighter tails.

It’s important to note that no single statistical measure can fully describe a distribution of data. Analysts often use a combination of measures to gain a more complete understanding of the data. For example, a distribution may be platykurtic but also highly skewed, indicating that the data is spread out but also heavily concentrated in one direction. By using multiple measures, analysts can better identify patterns and trends in the data.

The Future of Finance: Will Platykurtic Play a Bigger Role?

As financial markets become more complex and data sets become larger and more diverse, it is possible that platykurtic distributions will play an increasingly important role in finance. This is because platykurtic distributions can reveal important information about the distribution of data that is not captured by other statistical measures. However, it is also possible that other statistical measures will evolve that are better suited to the challenges of modern finance.

One potential advantage of using platykurtic distributions in finance is that they can help identify outliers in data sets. Outliers are data points that are significantly different from the rest of the data, and they can have a large impact on statistical analysis. By using platykurtic distributions, analysts can better identify and understand these outliers, which can lead to more accurate predictions and risk assessments.

How to Use Platykurtic to Your Advantage in Investment Analysis

If you are an investor, it is important to be aware of the potential impact of platykurtic distributions on investment decisions. One way to use platykurtic to your advantage is to focus on extreme outcomes. Platykurtic distributions tend to have more extreme outcomes than normal distributions, so it is important to be prepared for these possibilities.

Another way to use platykurtic to your advantage is to use statistical measures that are better suited to platykurtic data, such as percentiles or quantiles. This can help to provide a more accurate picture of the potential range of outcomes for an investment.

Additionally, it is important to consider the underlying factors that may be causing the platykurtic distribution. For example, if the distribution is caused by a high level of volatility in the market, it may be wise to adjust your investment strategy accordingly. On the other hand, if the distribution is caused by a unique opportunity or market inefficiency, it may be worth taking a closer look at the investment.

Identifying Potential Risks and Opportunities with Platykurtic

Platykurtic can be a useful tool for identifying potential risks and opportunities in financial data. By analyzing the shape and characteristics of the distribution curve, it is possible to gain insights into potential outliers or extreme outcomes. This can be particularly useful in risk management and investment analysis.

One of the advantages of using platykurtic is that it allows for a more nuanced understanding of the data. Rather than simply looking at averages or standard deviations, platykurtic takes into account the shape of the distribution curve. This can reveal patterns and trends that might not be immediately apparent from other types of analysis.

Another benefit of using platykurtic is that it can help to identify potential opportunities for growth or investment. By identifying areas of the distribution curve that are particularly high or low, it is possible to pinpoint areas where there may be untapped potential. This can be especially valuable for businesses or investors looking to expand into new markets or industries.

Implementing Strategies Based on Platykurtic Analysis for Better Financial Performance

If you are looking to enhance your financial performance, it may be worth considering implementing strategies based on platykurtic analysis. This could involve using different statistical measures or models that are better suited to platykurtic data, or focusing on extreme outcomes and potential risks and opportunities.

One example of a platykurtic analysis strategy is to use the mean absolute deviation (MAD) instead of the standard deviation to measure variability. MAD is less sensitive to extreme values, which can be more common in platykurtic distributions. Another strategy is to focus on tail risks, which are the extreme outcomes that occur with low probability but can have a significant impact on financial performance. By identifying and managing these risks, companies can better protect themselves from unexpected losses and take advantage of potential opportunities.

Enhancing Financial Forecasting Accuracy with the Help of Platykurtic

One of the key challenges in financial forecasting is accurately predicting the range of potential outcomes. Platykurtic can be a useful tool in this regard, as it can reveal important information about the distribution of data that is not captured by other statistical measures. By incorporating platykurtic analysis into financial models and forecasts, it may be possible to improve forecasting accuracy and reduce the risk of unexpected outcomes.

Another benefit of using platykurtic analysis in financial forecasting is that it can help identify outliers in the data. Outliers are data points that are significantly different from the rest of the data, and they can have a significant impact on the accuracy of financial forecasts. By identifying and removing outliers, platykurtic analysis can help improve the accuracy of financial models and forecasts.

Furthermore, platykurtic analysis can also be used to identify trends in financial data. By analyzing the kurtosis of the data, it is possible to determine whether the data is clustered around the mean or spread out more evenly. This information can be used to identify trends in the data, such as whether a particular market is becoming more volatile or less volatile over time. By incorporating this information into financial models and forecasts, it may be possible to make more accurate predictions about future market trends and conditions.

Conclusion

Platykurtic is an important statistical concept in finance that can reveal important information about the distribution of data. By understanding platykurtic and how it affects financial analysis and decision-making, it is possible to make better-informed and more accurate decisions. Whether you are an investor, risk manager, or financial analyst, being aware of platykurtic can help you to identify potential risks and opportunities and make better financial decisions.

It is important to note that platykurtic is just one of many statistical concepts that can be used in finance. Other concepts, such as skewness and kurtosis, can also provide valuable insights into the distribution of data. By combining these concepts, financial professionals can gain a more comprehensive understanding of the data they are analyzing and make more informed decisions.

Furthermore, as technology continues to advance, the use of statistical analysis in finance is becoming increasingly important. With the ability to process and analyze large amounts of data quickly and accurately, financial professionals can gain insights that were previously impossible to obtain. As such, understanding statistical concepts such as platykurtic is becoming more and more essential for success in the finance industry.