In the world of finance, there are plenty of terms that are often utilized but not quite well understood. One of these terms is “redlining.” While it’s rarely something that will come up in everyday conversation, it’s something that everyone should know about, especially those who are trying to secure loans or credit. In this article, we’ll be discussing redlining in detail – what it is, how it impacts different communities, and how you can protect yourself if you fall victim to it.

Understanding the Concept of Redlining in Finance

Redlining is a term that’s used to describe the practice of intentionally denying services or products to people in certain neighborhoods, typically due to their race or socioeconomic status. This practice is most commonly associated with the banking industry. In most cases, redlining involves denying loans or credit to people who live in areas that the financial institution deems to be high-risk. These high-risk areas are usually characterized by high levels of poverty, crime rates, and low property values.

The practice of redlining poses a significant danger to many communities across the United States. The denial of vital financial services can lead to a lack of growth and progress, which can have serious long-term consequences.

Redlining has a long and complex history in the United States. It was first introduced in the 1930s as part of the New Deal, which aimed to stimulate economic growth and recovery following the Great Depression. However, redlining quickly became a tool for discrimination, as banks and other financial institutions used it to deny loans and other services to people of color and low-income communities.

Despite the passage of the Fair Housing Act in 1968, which made redlining illegal, the practice continues to this day. Many communities of color and low-income neighborhoods still struggle to access basic financial services, such as loans and credit, which can make it difficult to start businesses, buy homes, and build wealth. Addressing the issue of redlining is crucial for creating a more equitable and just society.

The History of Redlining and Its Impact on Minority Communities

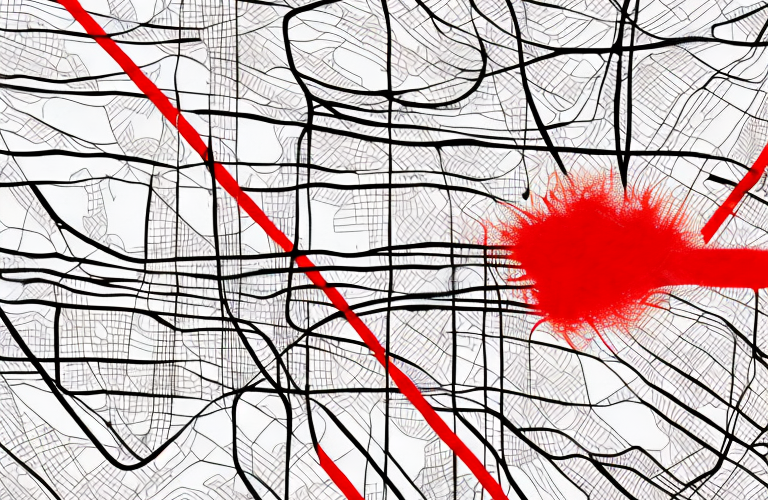

Redlining has a long history in the United States. In the 1930s, the Federal Housing Authority created maps that labeled certain neighborhoods as high risk. These neighborhoods were typically home to minority groups, particularly African Americans. Banks and other financial institutions used these maps as guidelines to determine which communities they would provide loans to, and which ones they would not.

The impact of redlining on minority communities has been severe. By limiting access to credit and homeownership opportunities, many neighborhoods were unable to grow and thrive. This has led to generational poverty and a lack of upward mobility for many people. Minority homebuyers were also often forced to pay higher interest rates than their white counterparts, even if they had the same credit scores and income levels.

Redlining also had a significant impact on the physical infrastructure of minority communities. As banks and other financial institutions refused to invest in these neighborhoods, they became neglected and underdeveloped. This lack of investment led to a lack of basic amenities such as grocery stores, healthcare facilities, and public transportation. This, in turn, made it difficult for residents to access essential services and contributed to the overall decline of these neighborhoods.

Despite the Fair Housing Act of 1968, which made redlining illegal, its effects are still felt today. Many minority communities continue to struggle with poverty, lack of access to credit, and limited opportunities for upward mobility. It is essential to acknowledge the history of redlining and its impact on minority communities to work towards creating more equitable and just communities for all.

How Redlining Affects Access to Credit and Homeownership Opportunities

Redlining can have a severe impact on access to credit and homeownership opportunities. When redlining occurs in a neighborhood, banks and other financial institutions are less likely to provide loans or other financial services to homeowners in that area. This, in turn, makes it more difficult for people living in those areas to purchase homes and improve their neighborhoods.

Without access to home loans and credit, many individuals and families in redlined neighborhoods end up living in substandard housing or renting for the entirety of their lives. This lack of access to credit can also perpetuate the cycle of poverty, making it difficult for people to access the resources they need to succeed and build their wealth.

Furthermore, redlining can also lead to a lack of investment in these neighborhoods, as businesses and developers may be hesitant to invest in areas that are deemed “high risk” by financial institutions. This lack of investment can result in a lack of job opportunities and economic growth in these areas, further perpetuating the cycle of poverty.

In addition, redlining can also have a negative impact on the mental health and well-being of individuals living in these neighborhoods. The stress and anxiety of living in substandard housing or being unable to access credit and homeownership opportunities can take a toll on one’s mental health, leading to a range of negative outcomes such as depression and anxiety.

The Legal Implications of Redlining in Modern Times

Redlining has been illegal since the passage of the Fair Housing Act in 1968. This act prohibits discrimination in the sale, rental, or financing of housing based on race, color, national origin, religion, sex, familial status, or disability. Discouraging an individual from applying for a loan or refinancing based on any of these protected classes is illegal, and financial institutions can face severe legal consequences as a result.

Despite the legal protections in place, redlining continues to occur today. Financial institutions must remain vigilant in their efforts to combat this practice and ensure that they are not discriminating against anyone based on their race or neighborhood.

One way that redlining can be identified is through the use of data analysis. By examining lending patterns and comparing them to demographic data, it is possible to identify areas where redlining may be occurring. This information can then be used to hold financial institutions accountable and ensure that they are complying with fair lending laws.

Ways to Spot Redlining Practices in the Financial Industry

It can be challenging to spot redlining practices in the financial industry unless you know what to look for. One of the most common ways to identify redlining is to research mortgage approval rates in different areas. If you notice a significant disparity in approval rates for people of color or those who live in low-income neighborhoods, it may be a sign that redlining is occurring.

Another way to spot redlining is to investigate whether a financial institution has a branch in a diverse area. If a bank has branches in affluent neighborhoods but none in low-income areas or neighborhoods of color, it may be redlining.

Additionally, you can look at the types of financial products and services that are offered in different areas. If a bank offers more favorable interest rates or loan terms in affluent neighborhoods compared to low-income areas or neighborhoods of color, it may be a sign of redlining.

It’s also important to pay attention to the marketing and advertising strategies of financial institutions. If a bank primarily targets affluent or white neighborhoods in their advertising, it may be a sign that they are not interested in serving diverse communities.

How to Protect Yourself from Redlining as a Consumer or Borrower

If you suspect that you are being subjected to redlining, there are steps you can take to protect yourself. It’s essential to be proactive and do your research before applying for a loan or credit. Shop around for different lenders and compare their rates and approval requirements. You should also monitor your credit report carefully to ensure that no errors or false information are hurting your chances of securing a loan.

If you believe that you have been a victim of redlining, reach out to a consumer protection or civil rights attorney for guidance. You may be able to file a complaint with a government agency or take legal action against the financial institution in question.

Another way to protect yourself from redlining is to educate yourself on the different types of loans and credit available to you. Some lenders may try to steer you towards subprime loans or other high-interest options, which can be a sign of redlining. By understanding your options and what you qualify for, you can make informed decisions and avoid being taken advantage of.

It’s also important to be aware of your rights as a consumer or borrower. The Fair Housing Act and Equal Credit Opportunity Act both prohibit discrimination based on race, color, religion, national origin, sex, familial status, or disability. If you feel that you have been discriminated against, you have the right to file a complaint and seek legal recourse.

The Role of Government and Non-profits in Combating Redlining

The government and non-profits have an essential role to play in combating redlining. Government agencies such as the Consumer Financial Protection Bureau and the Department of Housing and Urban Development are responsible for enforcing fair lending laws and investigating potential cases of redlining.

Non-profit organizations such as the National Community Reinvestment Coalition and the National Fair Housing Alliance also play a vital role in advocating for fair lending practices and providing resources and support to communities that may be affected by redlining.

In addition to enforcing fair lending laws and providing resources, government and non-profit organizations can also work together to create programs and initiatives aimed at addressing the root causes of redlining. For example, they can collaborate to provide financial education and counseling to individuals and families in underserved communities, as well as offer incentives to banks and lenders to invest in these communities.

Alternative Financing Options for Communities Affected by Redlining

For people and communities affected by redlining, there may be alternative financing options available. Community development financial institutions (CDFIs) and credit unions are two examples of institutions that may be more willing to provide loans to people in areas that have been redlined. These institutions are typically more community-focused and may have programs in place specifically for underserved neighborhoods.

Another alternative financing option for communities affected by redlining is crowdfunding. Crowdfunding platforms allow individuals and organizations to raise money from a large number of people, often through social media and other online channels. This can be a useful option for community projects or small businesses that may not qualify for traditional loans.

In addition, some cities and states have established programs to provide financial assistance to communities affected by redlining. For example, the City of Los Angeles has a program called the Affordable Housing Trust Fund, which provides funding for affordable housing projects in underserved neighborhoods. It’s important to research and explore all available options to find the best financing solution for your specific needs.

Success Stories of Communities That Have Overcome the Effects of Redlining

While the effects of redlining continue to be felt in many communities, there are also examples of communities that have successfully overcome these obstacles. Community organizing, partnering with non-profits, and demanding a fair and equitable financial system are all ways communities have been able to thrive despite redlining and other financial obstacles.

In conclusion, redlining is a dangerous practice that continues to impact many communities across the United States. By understanding what redlining is, how it works, and how it can be combated, we can all begin to work towards a more fair and equitable financial system.

One example of a community that has successfully overcome the effects of redlining is the historically black neighborhood of Bronzeville in Chicago. Despite being redlined for decades, the community was able to organize and demand investment in their neighborhood. Through partnerships with non-profits and local government, Bronzeville has been able to revitalize their community and attract new businesses and residents.

Another success story comes from the city of Richmond, California. This city was heavily impacted by redlining and disinvestment, leading to high levels of poverty and crime. However, through community organizing and advocacy, Richmond was able to secure funding for affordable housing, job training programs, and other initiatives that have helped to improve the quality of life for residents.